virginia estimated tax payments corporate

TaxFormFinder provides printable PDF copies of 76 current West Virginia income tax forms. The 2022 state personal income tax brackets are updated from the Virginia and Tax Foundation data.

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

TSD-3 MAILING ADDRESSES Page 2 of 2 Tax Account Administration Division.

. For Corporations and Partnerships Annual and Estimated. West Virginia State Tax. For Personal Income Tax Estimated.

The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. The extension applies to 2020 individual corporate. If your tax return shows a balance due of 540 or less the penalty is either.

Charleston West Virginia 25339-1514. This extension does not apply to corporate tax returns and payments and does not apply to individual and corporate estimated tax payments. Review the Form 2210 instructions for the year you have an estimated tax penalty.

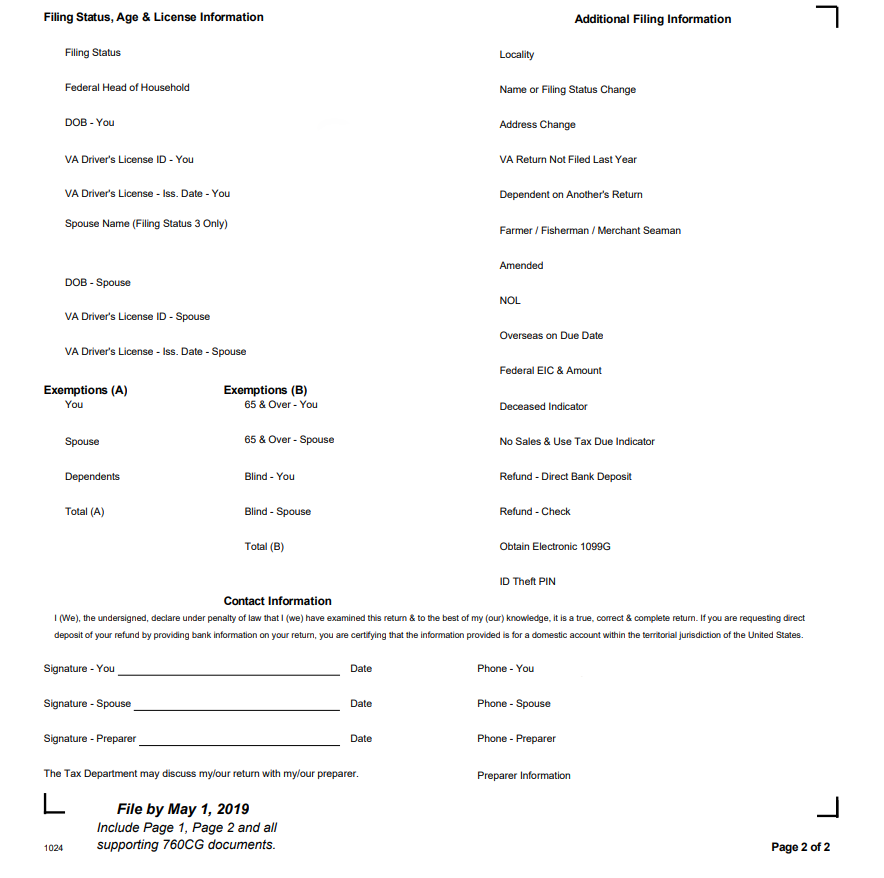

Conforming Fixed-Rate estimated monthly payment and APR example. Assuming your original return was correct you can ask the IRS for penalty abatement. Certain Virginia corporations with 100 of their business in Virginia and federal taxable income of 40000 or less for the taxable year may qualify to electronically file a short version of the return eForm.

For Corporate NetBusiness Franchise Estimated. If you qualify for a waiver send Form 843 or a letter with a full explanation about why the IRS should remove your estimated tax penalty and attach any supporting documentation. All corporations can file their annual income tax return Form 500 and pay any tax due using approved software products.

Virginia tax forms are sourced from the Virginia income tax forms page and are updated on a yearly basis. West Virginia has a state income tax that ranges between 3 and 65 which is administered by the West Virginia Department of Revenue. Before the official 2022 Virginia income tax rates are released provisional 2022 tax rates are based on Virginias 2021 income tax brackets.

Corporations that are required to make estimated payments of their tax liability are subject to additions to tax for failing to pay at least ninety percent 90 of their annual tax liability. 100 of the amount due. These estimated payments will remain due on April 15 2021.

How to File and Pay Annual income tax return. Generally most taxpayers will avoid this penalty if they either owe less than 1000 in tax after subtracting their withholding and refundable credits or if they paid withholding and estimated tax of at least 90 of the tax for the current year or 100 of the tax shown on the return for the prior year whichever is smaller. Attach to your West Virginia Corporate return a copy of pages 1 through 5 of your signed Federal Return as filed with the Internal Revenue Service.

California has a state income tax that ranges between 1 and 133 which is administered by the California Franchise Tax BoardTaxFormFinder provides printable PDF copies of 175 current California income tax forms. The maximum penalty is 25. Maryland July 15.

The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. From the original due date of your tax return. Make a Payment Bills Pay bills or set up a payment plan for all individual and business taxes Individual Taxes Make tax due estimated tax and extension payments.

After applying any payments and credits made on or before the original due date of your tax return for each month or part of a month unpaid. A 225000 loan amount with a 30-yea r term at an interest rate of 3875 with a down-payment of 20 would result in an estimated principal and interest monthly payment of over the full term of the loan with an Annual Percentage Rate APR of 3946. The new tax deadline for Maryland state residents is now July 15 2021.

Virginia Dpb Frequently Asked Questions

Virginia Dpb Frequently Asked Questions

Instructions On How To Prepare Your Virginia Tax Return Amendment

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Virginia Sales Tax Guide And Calculator 2022 Taxjar

Virginia Dpb Frequently Asked Questions

How To Make Tax Time Easy On Your Blog Or Va Business Tax Time Blogging Advice Estimated Tax Payments

Best Car Sales Tax In Roseville Ca In 2022 Cars For Sale Suv For Sale Used Suv For Sale

Virginia State Taxes 2022 Tax Season Forbes Advisor

41599 Epping Green Sq Aldie Va 20105 Aldie Va Aldie Realty

Tax Tip Have Virginia State Tax Questions Virginia Tax

Tax Tip Have Virginia State Tax Questions Virginia Tax

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Seller S Net Sheet Explained How To Project Your Home Sale Proceeds Printable Worksheets Cost Sheet Good Faith Estimate

Prepare And Efile Your 2021 2022 Virginia Income Tax Return

Where S My Refund West Virginia H R Block

Virginia Dpb Frequently Asked Questions

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation