german tax calculator berlin

Youll then get a breakdown of your total tax liability and take-home pay. The contacts for all questions concerning taxes are the tax offices and tax consultants.

German Tax Calculator Easily Work Out Your Net Salary Youtube

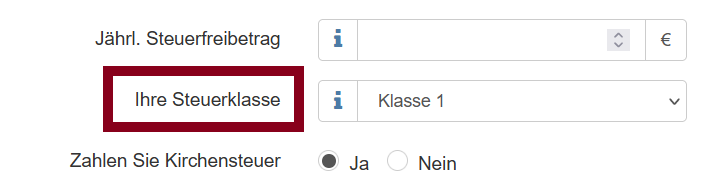

Your respective tax office will assign you a tax bracket.

. For this year 2020 the tax office has raised the taxable incomes by a small margin as follows. Our grossnet calculator enables you to easily calculate your net wage which remains after deducting all taxes and contributions free of charge. 3500 Euros per month.

For a final view on German taxes we kindly ask you to. This Income Tax Calculator is best suited if you only have income as self employed from a trade or from a rental property. The money collected through taxes is shared between the federal government states and local authorities.

16 19 5 7. Simply enter the basic data of the property and purchase fees. The German Annual Income Tax Calculator is updated to reflect the latest personal Tax Tables and German Social Insurance Contributions.

Please note that this application is only a simplistic tool. Taxes you pay in total are 26705 and consist of. Calculating property tax in Berlin.

If you wish to calculate your salary Social Insurance payments and income tax for a differant period please choose an alternate payment period or use the Advanced German Tax Calculator. Tax rates are calculated on progressive rates starting at 14 and rising to 42 or 45 for very high incomes. Then add your private expenses to calculate your taxable income.

420 234 261 904. Thats how fast it can be. Usually within 24 hours.

Your German Mortgage Repayment Calculator. It is charged at 55 of your total income tax paid. The base tax rate is 26.

This program is a German Income Tax Calculator for singles as well as married couples for the years 1999 until 2022. In which tax category do you fit in for the tax calculator Germany. Sales Tax in US varies by location.

First add your freelancer income and business expenses to the calculator. The uses of the money include the financing of schools roads and social support. For 2018 it is 7428 or 3714.

If you only have income as self employed from a trade or from a rental property you will get a more accurate. Progressive tax rate starting at 14 and progressing to 42. If you receive a salary only as an employee on a German payroll you get.

The SteuerGo Gross Net Calculator lets you determine your net income. Calculate United States Sales Tax. This Wage Tax Calculator is best suited if you receive a salary only as an employee on a German payroll.

German Grossnet Calculator Wage Calculator for Germany. In Germany the tax class you are in depends on your marital status. This will generate your estimated amount for your Profit and Loss statement.

Taxable income less than 9408 18816 is exempted from taxation. Our operators speak English Czech and Slovak. German Income Tax Calculator Expat Tax.

Just do your tax return with SteuerGo. It depends on your personal situation and which Tax Class you fall into which is explained further below. To be able to calculate property tax in Berlin certain criteria rules have to be considered.

Enter your Amount in the respected text field. Incomes exceeding 265327 530654 taxed at a flat rate of 45. How to use Berlin Sales Tax Calculator.

Do not fill in the currency. Counties cities and districts impose their own local taxes. The German Annual Income Tax Calculator for the 2022.

Choose the Sales Tax Rate from the drop-down list. Choose Income Tax Calculator. You then determine the repayment amount and.

You can enter the gross wage as an annual or monthly figure. In addition to calculating what the net amount resulting from a gross amount is our grossnet calculator can also calculate the gross wage that would yield a. Use the free German mortgage calculator to check your home loan repayment options.

Tax Calculator in Germany. You need to fill in two fields. Your tax calculation will look like this.

There is base sales tax by most of the states. Check your city tax rate from here Thats it you can now get the tax amount as well as the final amount which includes the tax too Method to calculate Berlin sales tax in 2021. Taxed at a flat rate of 42.

Also known as Gross Income. This report is called Anlage EÜR in German. To get an idea of how much income tax you will have to pay you can use this income tax calculator in German.

A lower property tax means a higher yield lower cost on your investment. You can enter the gross wage as an annual or monthly figure. If youre struggling to visualise how all of this affects your income a German tax calculator can give you a good idea of how much money youll actually take home each month.

Simply enter your annual salary to see a detailed tax calculation or select the advanced options to edit payroll information select different tax states etc. About the German Income Tax Calculator The German Income Tax Calculator is designed to allow you to calculate your income tax and salary deductions. From 55961 111922 to 265326 530652.

The child allowance for 2019 is 7620 for a joint tax return or 3810 per parent. In Berlin for example only 15 of local residents own their flats. Solidarity surcharge appears on your payslip as SolidZuschlag.

In Germany there are 40 different taxes. There are 6 tax brackets Steuerklassen in Germany. In the results table the calculator displays all tax deductions and contributions to mandatory social insurance on an annual and monthly basis.

Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Germany affect your income. The tax bracket Steuerklassen you end up in is dependent on your marital status. German Grossnet Calculator Wage Calculator for Germany.

What are the purchase fees for a property in Berlin. See what your monthly rate is with different German mortgage rates. For assistance in other languages contact us via e-mail infoneotaxeu.

The German Tax calculator is a free online tax calculator updated for the 2022 Tax Year. This mortgage calculator gives you a quick overview of your real estate financing in Germany. This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022.

Try our instant tax calculator to see how much you have to pay as corporate tax dividend tax and Value Added Tax in Germany as well as detect the existence of any double taxation treaties signed with your country of residence. For example an employer can calculate an employees income tax Lohnsteuer by means of the tax brackets. Germans are notably known to be unwilling to invest into stone or land.

Salary Before Tax your total earnings before any taxes have been deducted. For 2017 it is 7356 or 3678. It is very easy to use this German freelancer tax calculator.

You are living in Berlin the capital of Germany. As you may imagine not every citizen is in the same tax bracket. The down-payment should be at least the amount of your purchase fees which will also be calculated.

Just ring us through and we will call you back as soon as possible. German Wage Tax Calculator Expat Tax.

![]()

Calculator German Umbrella Company

How The Basic German Income Tax Calculation Works Finance Toytown Germany

German Payroll Example For 18000 18k Income Ta

Credit Kredit Photos Free Royalty Free Stock Photos From Dreamstime

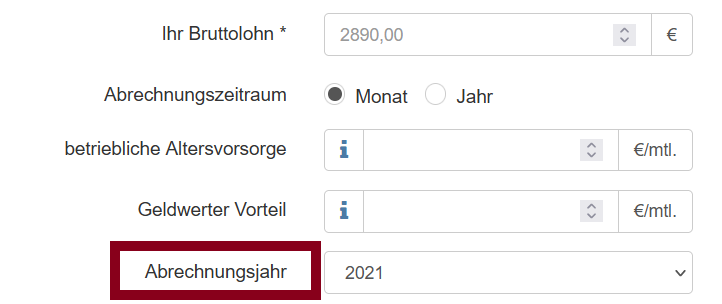

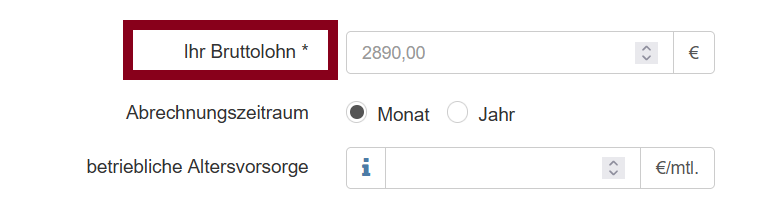

Salary Calculator Germany 2022 User Guide Examples Gsf

Salary Calculator Germany 2022 User Guide Examples Gsf

Salary Calculator Germany 2022 User Guide Examples Gsf

Questions About Taxes And Frozen Accounts Finance Toytown Germany

How Much Is E13 Tvod Bund Salary Is It Enough To Live In Berlin For A Family Of 4 Quora

Working Student Social Media F M D At Clariness Be Berlin Ge

Cost Of Living In Germany How To Save Money My Life In Germany

Calculator German Umbrella Company

German Tax Calculator Easily Work Out Your Net Salary Youtube

Employees On Kurzarbeit In Germany May Have Higher Tax Burden In 2021

Taxes In Germany The Basics For Self Employed

Salary Calculator Germany 2022 User Guide Examples Gsf

Working Student Social Media F M D At Clariness Be Berlin Ge